As 2009 came to a close, Time Warner Cable narrowly averted the removal of Fox channels (owned by Rupert Murdoch’s News Corporation) from its channel lineup, and Cablevision failed to do the same for Scripps Networks’ Food Network and HGTV channels. The issue, of course, is money: the content providers want to raise the fees for their channels, and the service providers want to avoid passing on yet another round of higher fees to their subscribers. (See also here, and here.)

These sorts of disputes amount to a form of extortion, where the consumer winds up as the victim. We could say that it’s a free market, and we should let free-market economics decide the matter, but that would be ignoring the monopoly situations that exist here. Whether you like Fox News or not, it’s clear that it’s a unique service, and that lovers of Bill O’Reilly, Glenn Beck, and their ilk can find that programming from no other source. The Fox channels also carry popular programs such as The Simpsons and American Idol. Similarly, if one wants to watch Rachael Ray, Bobby Flay, Mario Batali, and Emeril, one finds them on The Food Network... or not.

The content providers know that, and use the power they get from the popularity of their programming to make demands of the service providers, knowing they have them over a barrel, but the service providers are not innocent either. There’s little choice of service providers even in large markets, and no choice at all in the smaller markets. Where I live, I choose between Cablevision and Verizon... or I can switch to satellite, which is not an appealing option.

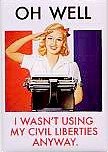

The result is that the service providers can charge pretty much what they want to, and can set up their packages as they please... and we, the consumers, are stuck with what they offer, or nothing.

And what they offer is designed to have us pay dearly for what we don’t want, in order to get what we do. A few years ago, the New York Yankees demanded that Cablevision carry their YES channels on the basic cable service, ostensibly “making them available to all subscribers,” rather than having only subscribers who wanted those channels pay the extra fee. The Yankees won, and the result was that all subscribers had to pay $2 more per month, whether we wanted the YES channels or not (I do not).

The same is true with many of the other price hikes that go on: ESPN, Fox, the Scripps channels... increased rates on these force rates up for all subscribers, because we don’t have the option to choose to take one, but not the others. And that is dictated by the service providers (and by the contracts that they agree to for the content). The content providers feel they have to hike up their charges to make up for lost advertising revenue, which has been on the wane for a while.

I can’t tell you how many channels I get on my Cablevision system now — the number has gone up from “a bunch”, to “a boatload”, to “more than one can imagine”, over time. But I can tell you how many I ever watch: sixteen. There are eight I use regularly, and eight more occasionally. And that’s it. I am paying for Fox, for sports (at least a dozen sports channels, and maybe more), for children’s programming, for old sitcoms, for music videos, and for the credulous garbage aired by “Discovery” and its sisters, all without wanting to.

And it’s no small amount. When I first got cable TV, I paid $30 a month for it, and even that seemed like a lot when I compared it to getting free TV over the airwaves, paid for by advertising. I’m now paying over $80 a month, when you add everything up — the basic fee, the rental on the cable box, the rental on the remote control for the cable box, the taxes and extra charges, and so on — and the next price hike comes at the whim of Scripps (or Fox, or ESPN, or the New York Yankees).

Scripps, of course, for its part, says that they’re not being paid what their content is worth, and they have to take a stand and demand proper compensation for it. It’s hard to argue with that, particularly since the subscribers (the customers, us) can’t weigh in, at least not in a meaningful way. Not with our wallets.

Here’s where regulation needs to step in... but not to force accommodation one way or another, as the courts did with the YES situation. The service providers should be required to offer channel selections à la carte. Subscribers should be able to pay for exactly the channels we want, and not to pay for those we don’t want. The service providers may certainly offer discounted packages for channel groupings, as they do today. But unlike today, customers should have a choice, channel by channel.

And then if Scripps wants to make Cablevision customers pay a few dollars per month more, we will have the option of saying “No,” by simply dropping those channels from our subscriptions, no longer forced to keep them in order to be able to watch PBS and CNN.

There are dire warnings going around that setting up channel selection that way will kill all the small channels, aimed a specific markets — that channels such as BET and Lifetime will disappear because not enough households will pay for them, when they have to pay directly. I don’t agree with that assessment, and neither does Consumers Union, which has been pushing for this for years.

À la carte pricing won’t happen unless we demand it, loudly, both to our service providers and to our regulators. So let’s go!